Will government meet tax revenue collection targets in 2017/18?

What you need to know:

- This has prompted economists to call for the government to seriously work on broadening the tax base by taking bold steps to reduce the cost of doing business as the new budget for the 2018/19 financial year that commences on July 1 this year is expected to be tabled on Thursday, June 14.

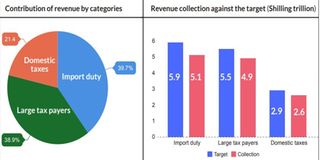

Dar es Salaam. Revenue collection from large tax payers for the period of 10 months between July 2017 and April this year fell short of the target by a marginal 10.78 per cent.

This has prompted economists to call for the government to seriously work on broadening the tax base by taking bold steps to reduce the cost of doing business as the new budget for the 2018/19 financial year that commences on July 1 this year is expected to be tabled on Thursday, June 14.

This would reduce the tax burden to a few taxpayers and hence attracting more investors who would be eligible to pay tax.

Tabling the proposed budget for the Ministry of Finance and Planning earlier this month, the minister, Dr Philip Mpango said the Tanzania Revenue Authority (TRA) collected Sh4.9 trillion in the first ten months of the current financial year against the target of Sh5.4 trillion set by the Treasury for the large taxpayers department.

The collections were 7.09 per cent more than Sh4.5 trillion, the taxman recorded the previous year, largely attributed to the commitment of the taxman and various leaders as well as the increased taxpayers’ compliance, according to TRA tax-payer services and education director, Mr Richard Kayombo.

“Transparency in tax collection and expenditure of the collected revenue tends to attract more tax payers,” he told The Citizen in an interview.

However, the performance during the first 10 months of the current financial year received criticism from economists on the grounds that it was not reflecting increased investments.

To attract more large tax payers, Repoa strategic research director Abel Kinyondo advised the government to improve the business environment by reducing tax burden and embracing policy predictability.

Spelling out coherent policies that add up to a growth strategy would bolster business confidence and hence encourage the all-important process of job creation and investment.

“Enough is enough for hard-pressed tax payers. We deserve a pause on new tax-raising measures until the other side of the equation in the process starts to contribute – cuts,” noted Dr Kinyondo

Warning: “Shifting burden to a few Tanzanians who have registered their businesses as well as companies which have dedicated to paying taxes, may end up scaring away investors.”

His sentiment was echoed by Prof Haji Semboja of the Zanzibar University’s Economics department on the grounds that the government should come up with a fair tax regime.

Economists say the most important message on tax should be “no more rises”

“Little has been done in making more people taxable. It is high time the government incorporated more tax-payers from the informal sector,” said Prof Semboja.

He said there are many producing companies and individuals who are not approached by the tax collection body and in that way, they end up dodging taxes.

“A number of business in the informal sectors have been left to operate without remitting taxes hence suppressing the few. But I am optimistic with the fifth regime no stone will remain unturned,” noted Prof Semboja.

He was seconded by Prof Delphin Rwegasira of the University of Dar es Salaam’s Economics department, stressing that there is still some more works to do.

In economics point of view, political will from government is key to raising domestic revenue as only workers in the formal sector have been subjected to paying tax

“Government should widen the tax base by ensuring every Tanzanian with an income pays tax as this will reduce the tax burden that has been shifted to a few,” noted Prof Rwegasira.

The TRA is already doing that, according to Mr Kayombo. The taxman has already started registering small traders in the informal sector, including hawkers popularly known as ‘Machingas,’ Mr Kayombo added.

TRA was planning to record at least one million new taxpayers by the end of this month.

Currently, the number of taxpayers who are partly depended upon for financing the budget, stands at 2.615 million.

Going by the 2017/ 18 budget, TRA is tasked with collecting Sh17.1 trillion to partly finance the government’s Sh31.7 trillion revenue and expenditure plan.

However, during the first 10 months of this financial year period under review, TRA missed a target in revenue collection by 11.2 per cent.

The collection stood at Sh12. 6 trillion, an 8.3 per cent increase compared to performance posted in the preceding year.

This suggests that, on average the taxman has been collecting Sh1.26 trillion per month.

To meet its overall target for the current financial year, the taxman will need to pull up its socks and collect a staggering Sh4.5 trillion in two months - May and June.