Banks shift lending to trade and manufacturing sectors

What you need to know:

BoT says in its latest economic and operational annual report that during the previous year (2015/16), personal loans were the major target for banks’ lending, accounting for 20 per cent of total lending, while its annual growth was 32.7 per cent.

Dar es Salaam. Banks and financial institutions made major shift in lending to the private sector during the financial year 2016/17, according to the Bank of Tanzania (BoT).

BoT says in its latest economic and operational annual report that during the previous year (2015/16), personal loans were the major target for banks’ lending, accounting for 20 per cent of total lending, while its annual growth was 32.7 per cent.

The mining sector also had the highest growth with 32.9 per cent during the year 2015/16.

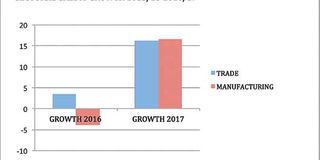

During 2016/17 banks shifted their lending policy, targeting trade and manufacturing, important sectors which pave the road to industrialisation.

Share of lending to manufacturing sector accounted for 11.4 per cent of total lending in 2016/17 from 9.9 per cent in 2015/16. Its growth went up to 16.6 per cent in 2016/17 from a contraction of four per cent in 2015/16.

Trade, whose share was 18.8 per cent during 2015/16, gained to 21.6 per cent and its growth jumped to 16.1 per cent during the financial year 2016/17 from 3.5 per cent in 2015/16.

The sectors which suffered a shrink in lending during the period under review were personal loans which its share slowed to 18.8 per cent from 20.1 per cent, and transport and communication whose share went down to 5.8 in 2016/17 from 7.5 per cent in 2015/16.

The growth of personal loans also recorded a contraction of 5.8 per cent during the year 2016/17 from a growth of 36.7 per cent during the previous year.

Agriculture, which is a major contributor to the economy, experienced a drop to 7.3 per cent of the share from 7.4 per cent but it recorded a contraction of 0.2 per cent from zero growth.

Slow growth was also experienced in transport and communication which contracted by 22.1 per cent in 2016/17 from a growth of 8.6 per cent during the previous year.

The report shows that credit to the private sector increased at a slower pace by 1.2 per cent in 2016/17 compared with 19.1 per cent in 2015/16.

In absolute terms, loans extended by banks increased by Sh206.2 billion during the year ending June 2017 to a stock of Sh16,866.2 billion, compared with an increase of Sh2,670.1 billion in the year to June 2016.

The slower pace of increase in credit reflected the cautious approach taken by most commercial banks in extending credit, following weakening of their asset quality particularly the increase in non-performing loans.

In addition, credit grew slowly due to other factors such as slowdown in consumption demand, slower growth in deposits, and asset portfolio diversification by banks in favour of low risk government securities.

The slowdown in credit growth was manifested in most of the major economic activities, notably transport and communication, personal and agricultural activities.

Regarding credit to the government by the banking system, it declined by 21.0 per cent in net terms during the year ending June 2017, compared to the increase of 41.1 per cent recorded in the year to June 2016.

This was largely driven by a build-up of deposits at the Bank of Tanzania, following improvement in domestic revenue collection, expenditure control, and receipt of external non-concessional loan towards the end of the 2016/17 financial year