BoT eyes credit recovery growth

What you need to know:

In its Monetary Policy Statement (MPS) for February, the central bank said the policy will also aim at supporting various economic activities.

Dar es Salaam. The Bank of Tanzania has said it will continue to maintain the accommodative monetary policy stance to stimulate the recovery of growth of credit to private sector.

In its Monetary Policy Statement (MPS) for February, the central bank said the policy will also aim at supporting various economic activities.

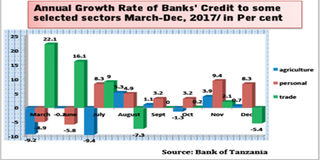

According to a statement, annual growth of credit to the private sector recovered to 1.7 per cent in December 2017, from the average contraction of about 1.5 per cent recorded in September and October 2017.

“The observed growth, which is still below the recorded levels, reflects cautious approach taken by banks in extending credit to the private sector in the face of increasing non-performing loans, coupled with increased preference for low risk government securities,” says BoT statement.

It reads, in the second half of 2017/18, the BoT will maintain the accommodative monetary policy stance aiming at stimulating further the recovery of growth of credit to the private sector and general support of various economic activities.

Accommodative monetary policy occurs when the central bank attempts to expand the overall money supply to boost the economy when growth is slowing (as measured by GDP).

“Using appropriate monetary policy instrument mix, the bank will continue to closely monitor and manage movements in banks’ clearing balances in order to instil stability of money market interest rates,” says BoT statement.

The Bank says will continue with liquidity easing policy stance for the remainder of the 2017/18, while maintaining stability of money market interest rates.

However, the growth of money supply will be kept within a range consistent with the medium-term inflation target of 5 per cent, and real GDP growth of about 7 per cent.