Tanzania concerned as FDI inflows dwindle for three years

What you need to know:

- They cite policy unpredictability, inadequate incentives to investors, delays by the government in making decision on some major projects and the multiplicity of regulatory bodies.

Dar es Salaam. Foreign direct investment (FDI) inflows into Tanzania have dwindled for the third year running, with analysts citing an unsound business environment as the reason for the decline.

They cite policy unpredictability, inadequate incentives to investors, delays by the government in making decision on some major projects and the multiplicity of regulatory bodies.

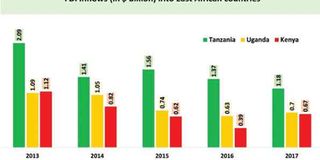

FDI inflows, according to United Nations Conference on Trade and Development, dipped by 24.4 per cent last year to $1.18 billion (about Sh2.6 trillion) compared with the 2015 level.

Last year it, FDI inflows dropped by 13.8 per cent compared with the previous year’s.

That shows something is wrong with Tanzania’s competitiveness, experts opine.

To reverse the trend, the Ministry of Industry, Trade and Investment on May 18, 2018 come up with a blueprint to address the challenges.

Speaking during the 59th Association of Tanzania Employers (Ate) meeting, the permanent secretary in the Ministry of Industry, Trade and Investment, Prof Elisante ole Gabriel, said the government was aware of some unresolved issues like conflicting laws and legal framework, impede businesses.

“We were ranked the 137th position globally in the Doing Business Report in 2018 compared to the 132nd position in 2017. But with the new blueprint in place, the challenges will be tackled,” noted Prof Ole Gabriel.

Tanzania Private Sector Foundation (TPSF) executive director Godfrey Simbeye advises the government to speed up the implementation of the blueprint to create a friendly environment to investors.

He underscored the importance of policy predictability to attract investors. According to him, the private sector likes changes.

He also attributed the dwindling of FDI inflows to unimpressive performance of the oil and gas sub-sector.

He called on the government to decide whether or not to a liquefied natural gas facility should be constructed.

To restore the investors’ confidence, the business environment should be improved.

“The expected relative risk/reward ratio is the driving force of investment decisions. As it happens, investors tend to invest in countries and projects where they expect the highest return and the lowest risk relative to alternative investment opportunities,” Mr Simbeye told BusinessWeek.

Return on investment, according to the report, is in decline across all regions, with the sharpest drops in Africa, Latin America and the Caribbean. Pointing out that global average return on foreign investment is now at 6.7 per cent, down from 8.1 per cent in 2012.

The lower returns on foreign assets also affect longer-term FDI prospects. As a result of the investment downturn, the rate of expansion of international production is slowing down.The modalities of international production and of cross-border exchanges of factors of production are shifting from tangible to intangible forms.

Going by the report, FDI inflows to Africa are forecast to increase by about 20 per cent in 2018, to $50 billion (about Sh113 trillion).

The projection is underpinned by the expectations of a continued modest recovery in commodity prices and macroeconomic fundamentals.

The report suggests for strategic review of investment policies for industrial development that would in turn attract FDI.

It advises policymakers to keep investment policy instruments up-to-date by re-orienting investment incentives, modernising special economic zones, retooling investment promotion and facilitation, and developing smart mechanisms for screening foreign investment.

Mr Simbeye, who is also, a member of Tanzania Investment Centre board of directors, says Ethiopia, South Africa and China perform well.

He would like the government to establish fully serviced industrial parks to attract investors’ attention and hence attract more FDI.

“The challenge that we are grappling with is lack of the ‘FDI targets’. We should emulate South African government, which has formed a task force comprising four ministers and representatives from the private sector to raise $100 billion (about Sh226 trillion) in three years,” Mr Simbeye said. Confederation of Tanzania Industries (CTI) second vice chairman Shabbir Zavery cites the multiplicity of regulatory agencies, attracting multiple fees, sending high operational costs and scaring away investors.He also linked negative the performance to the government’s spending cuts by banning what was termed as “unnecessary government officials’ foreign trips”, purchase of first-class air ticket and an order that the government meetings be held in government buildings instead of expensive hotels. Ceteris paribus, these have a negative impact on aggregate demand for products and hence discouraging investors.

“We are competing for FDI but the question is on how aggressive we are to win it,” noted Mr Zavery. “We need to bolster confidence to foreign investors that Tanzania continues to have stable policies and a conducive business environment.”

Economics professor Samuel Wangwe, of the University of Dar es Salaam, said some investors, who were in the past taking undue advantage, were feeling the pinch of the opaque regulatory environment and corruption crackdown, which increased significantly since the fifth government came to power in 2015.

“The economy is not in a better shape due to increased regulatory investment policies,” he said. “However, this is just a transition period and already there are signs that the situation is improving.”

According to him, encouraging progress in dealing with unscrupulous businesses has been made.

He said the path ahead was clear and Tanzania would be well positioned to attract FDI sustainably.

FDI is the largest external source of finance for developing economies.

It makes up 39 per cent of total incoming finance in developing economies as a group.

It now accounts for less than a quarter in the least developed countries, with a declining trend since 2012. Prof Wangwe said if Tanzania was to benefit, it should attract FDI which triggers technology spillover, assist human capital formation, help create a more competitive business environment, contribute to international trade integration and enhance development.

He said the government had powers to improve the situation.

“This bodes well for the future of Tanzania’s investment environment should the government continue to try to tackle these issues through its reform agenda.”

Although FDI inflows are declining, Tanzania is in a stronger position compared with other member states of the East African Community, with analysts linking the performance with relative better economic growth, return on investment and lower competition in the country.

Going by the report, last year’s investment inflows to Uganda and Kenya stood at $700 million and $672 million respectively.