Soft drinks producers want tax relief to avoid turbulence

What you need to know:

This came hard on the heels of the decline in prices for carbonated soft drinks due to its elasticity in demand.

Dar es Salaam. Last year, the carbonated soft drinks industry in Tanzania sent packing home some 725 employees as a result of a steep decline in sales volumes, the Confederation of Tanzania Industries (CTI) has revealed.

This came hard on the heels of the decline in prices for carbonated soft drinks due to its elasticity in demand.

To increase sales, the industry had to roll back its selling prices to the year-2012 prices.

“The industry needs a breathing space to grow again – and, hence contributing more revenue to the government in terms of value-added tax (VAT) and corporate tax,” CTI told The Citizen.

“Prices for soft drinks are very elastic. Any small change in the price does have a huge impact resulting in decreases in terms of sales and volumes,” the Confederation said, explaining that it is on those grounds that the industry held up the price for five years.

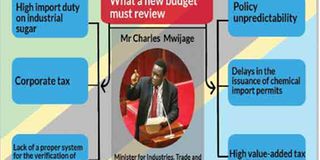

In that event, CTI in its tax reform proposals for the 2018/19 financial year proposes that the current excise duty on carbonated soft drinks of Sh61 per litre is maintained.

It is worrisome that an increase in excise duty would lead to a price increase that would further reduce sales volumes – and, by extension, investor confidence. If the sector is to grow – and, thus, help the government to garner revenue while creating employment in the value chain stakes – the tax system must be friendly, and be seen to be friendly.

“Mushrooming of the sector will have the multiplier effect up and down the value chain, including increased demand for inputs: sugar and packaging, to name just two.

Failure to do this, CTI warned, would lead to loss of government revenue even as it would fuel the proliferation of substandard soft drink products. All the member-countries of the Southern African Development Community (SADC) who had imposed excise duty on soft drinks – with the exception of Tanzania and Angola (3 per cent) – have removed the duty thereon.

These include Zambia, Zimbabwe, Namibia, South Africa and Malawi, all of which removed excise duty on soft drinks in the last few years, resulting in growth of the industry hand-in-hand with government revenues. Stakeholders in the industry are optimistic that the government will not in its FY-2018/19 budget go down a path that is likely to make the lives of its poor subjects even more difficult, observers say.

They are of the view that measures by the government to boost its coffers should not be a blow to people who can barely make ends meet.

In that regard, CTI also believes that a good tax system should meet basic conditions by being fair, adequate, simple, transparent and administrative-ease. Companies and consumers alike believe that an effective tax system should be one that encourages growth of industries, and attracts investments.

“The current taxation system still faces a number of challenges and, hence, the need for reforms,” says CTI, “This will ensure an increase in government revenue collections while, at the same time, it gives the private sector optimal conditions for growth – thereby creating jobs and prosperity for the country.”