Concern over industrialisation as importation of capital goods falls

What you need to know:

Importation of machinery, transport equipment, building and construction materials which are expected to stimulate industrial development all declined in the year ending January 2017, according to the February monthly economic review of the Bank of Tanzania (BoT).

Dar es Salaam. Tanzania’s imports are declining significantly including that of capital goods, raising concerns over the direction of investment in the country which is gearing-up for industrialisation.

Importation of machinery, transport equipment, building and construction materials which are expected to stimulate industrial development all declined in the year ending January 2017, according to the February monthly economic review of the Bank of Tanzania (BoT).

Imports of machinery declined to $1.41 billion this February compared with $1.77 billion recorded in the corresponding period last year while that of transportation equipment reduced from $1.06 billion to $780.9 million.

Building and construction materials also decreased from $872.2 million to $632 million.

However, imports of industrial raw materials increased from $802.7 million to $901.7 million.

That is happening in the backdrop of narrowing gap between exports and imports following a minimal improvement of exports – mostly traditional ones - and a significant drop of the imports.

While exports increased by 5.1 per cent to 9.34 billion, imports of goods and services decreased by 15.3 per cent to 10.49 billion during the year.

Analysts believe that increased exports make more economic sense if much of the rise comes from the manufactured goods category especially in a country that is striving to build an industrial economy like Tanzania.

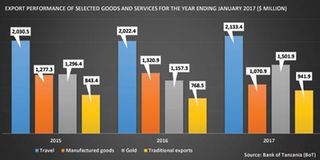

On the contrary, export of manufactured goods dropped from $1.321 billion during the year ending January 2016 to $1.07 billion during the year ending January 2017 on the back of sliding exports of edible oil and iron and steel products.

As for imports, all the categories of goods declined, except for industrial raw materials during the year under review.

A significant decline was marked in capital goods, oil, fertilizers, and food and food stuffs.

The import bill for oil, which accounts for the largest share of goods import, declined by 11.6 per cent to $2.47 billion due to a fall in prices in the world market, as the volume remained broadly the same.

The prices of white petroleum products in the world market declined by 16.7 per cent to $516.3 per metric tonne compared with $619.6 per metric tonne in the year ending January 2016.

However, the main concern among the experts is the decline of imports of capital goods which were expected to increase as Tanzania is campaigning for industrialisation.

“That is probably due to slowdown of investment especially in the industries,” says Prof Honest Ngowi of Mzumbe University’s School of Business.

“And if the trend is sustained, it raises a concern on the dream of industrialization which Tanzania has,” he says.

Previous reports indicate that the importation of capital goods has been volatile for many years but increment was expected at this time when there is movement for industrialisation.

Tanzania eyes becoming a middle income country come 2025 but the fifth phase government wants to make it industrial economy by 2020.

Economist Prof Samuel Wangwe has similar views about the reasons for declining imports of capital goods saying if it becomes a trend then it could affect the economic growth.

“What the government can do now is to come out clearly and create confidence to the investors who might have been holding investment since the general election,” says Prof Wangwe.

The experts also say that the narrowing of the gap between exports and imports has no much positive impacts since it’s mainly driven by decreasing imports instead of increasing exports.

They also said there’s a need to dig deeper and understand why the investment was slowing in the country and address the issues behind.

Another economist who sought anonymity said the country was experiencing slowdown of implementing various development projects since the current government introduced austerity measures that had cut government spending.

Tanzania’s industrial sector experienced an average annual growth of 8 per cent over the past 5 years.

The general industrial structure of Tanzania is comprised of manufacturing (53 per cent), processing (43 per cent), and assembling industries (4 per cent), according to an online publication TanzaniaInvest.com.

Since agriculture is the mainstay of the Tanzanian economy, the manufacturing industry is centered on the processing of local agricultural goods.

Export of manufactured goods declined to $1.07 billion from $1.32 billion in the year ending January 2016. Items that declined include edible oil, iron and steel products.

Currently, the majority of crops in Tanzania are marketed in their raw forms, while value-addition to agricultural products is mostly on small-scale secondary level.

Construction materials in Tanzania include cement and cement products, bricks and building blocks, wood building columns, and others.

Tanzania’s cement production is estimated at about 7.1 million tonnes a year, while local consumption is 4.1 million tonnes.