New plan to attract airport cargo

What you need to know:

Key on the agenda – which also seeks to improve the general performance of cargo handling at Tanzania’s airports - is improving infrastructure as well as regulatory and institutional framework.

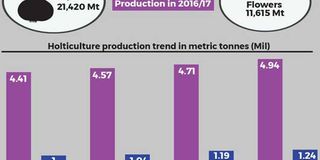

Dar es Salaam. Players in the aviation sector are devising strategies that will ensure that the bulky of horticultural and other products, harvested in Tanzania, are airlifted from one of the country’s airports.

Key on the agenda – which also seeks to improve the general performance of cargo handling at Tanzania’s airports - is improving infrastructure as well as regulatory and institutional framework.

Traditionally, about 80 per cent of Tanzania’s horticultural products were being airlifted to international markets via Kenya’s Jomo Kenyatta International Airport (JKIA).

Despite deliberate efforts, undertaken in 2015 by aviation authorities in the endeavor to bring the cargo to Dar es Salaam’s Julius Nyerere International Airport (JNIA) and Kilimanjaro International Airport, a substantial tonnage still passes through JKIA.

Tanzania Civil Aviation Authority (TCAA) figures show that while Tanzania has once been ranked on a list of top 20 producers of vegetables worldwide, the country has never been ranked on the list of top 20 exporters, suggesting why infrastructural and institutional challenges were holding the country’s potential back.

Infrastructure

Speaking during a recent national aviation forum in Dar es Salaam, the acting economic regulation director at Tanzania Civil Aviation Authority (TCAA), Mr Daniel Malanga said closing the infrastructure deficit is vital for Tanzania’s economic prosperity and sustainable development of air cargo business.

“As things stand, 40 per cent of fruits and vegetables harvested in the country get rotten each year before they can be transported….Improved infrastructure will help to change this unfortunate scenario,” he said.

For this to work, players are looking to the execution of infrastructure development projects with a lot of optimism.

During the 2016/17 financial year for instance, the Parliament approved a total of Sh2.176 trillion for the construction of roads, railways and ports, under the works docket in the Ministry of Works, Transport and Communication.

However, as of April, 2017 – two months before the closure of the financial year – only Sh1.171 trillion or 53 per cent of the budget – had been disbursed, according to figures produced in Parliament in June this year by the Minister for Works, Transport and Communication, Prof Makame Mbarawa. During the current financial year, the government is looking forward to spending a total of Sh1.9 trillion on various development projects pertaining to construction of roads, railways and ports among others.

Part of the money goes towards the construction of Terminal 3 at the JNIA and aviation players are hopeful that it will help to up both passenger and cargo figures (Also read the sidebar).

Regulations

On the regulatory aspect, players want authorities to have a relook at the licensing of ground handling firms.

An aviation consultant, Mr Gaudence Temu is specifically bitter with the licensing of airline operators to also undertake ground handling activities.

Apart from liberalizing the ground handling business at major airports, authorities are also allowing airline operators like Precision Air and Air Tanzania to register and undertake ground handling services.

With the small size of the market itself, coupled with the fact that most airline operators are currently struggling, Mr Temu - who doubles as former chief executive officer for Swissport Tanzania – believes slim are the chances of attracting investment into the sub-sector.

To attract an increased number of air cargo, Mr Temu proposes the need for the government to become flexible in the way it treats air cargo.

As things stand, all-cargo operators experience a lack of flexibility in market access rights under bilateral agreements in which air cargo is treated as part of passenger services.

As such, all the limitations - usually imposed on passenger services in respect of routes, traffic rights, frequency and among others - may also apply to all-cargo services.

But according to Mr Temu, such regulatory restrictions often make it difficult for air carriers to sustain an economically viable all-cargo service.

The Swissport chief executive officer, Mr Mrisho Yassin shared similar sentiments, insisting that the industry should thus be nurtured and supported.

Authorities are also required to act by working on space to accommodate transit cargo at airports, according to the Emirates Airline cargo manager Benny Ngozi. “Generally, investment in air cargo infrastructure is over-looked…it is high time airports expanded cargo area to provide a strong impetus to the air cargo sector,” said Mr Ngozi.

Flexible approaches

However, Mr Malanga, said in an effort to widen the air cargo market’s size, various countries are now adopting more flexible regulatory approaches.

The International Civil Aviation Organisation (ICAO), said Mr Malanga, has also developed guidance, in the form of model clauses for air transport agreements, for optional use by states in liberalizing air cargo services.

It was in view of such arrangements, he said, that Tanzania has been able to liberalize most of its Bilateral Air Services Agreements (Basas) with other countries to attract cargo carriage.

“We are underway towards walking the talk on the Yamoussoukro Decision on liberalization of air transport in Africa by consideration of signing a solemn commitment on the single African aviation market,” he said, noting that caution will be taken to protect local companies.