Reduced imports, unpredictable aid hamper budget execution

What you need to know:

The Tanzania Revenue Authority (TRA) had to grapple with a steep decline in imports at the nation’s largest port Dar es Salaam last year, latest data show.

Dar es Salaam. Reduced imports, falling tax revenue collections and unpredictable donor funding adversely affected implementation of the Government budget for the 2016/17 financial year, data show.

The Tanzania Revenue Authority (TRA) had to grapple with a steep decline in imports at the nation’s largest port Dar es Salaam last year, latest data show.

This happened at a time when employers were cutting costs every which way – including laying off some of their workers – in efforts to realign their operations with the prevailing business and other economic conditions.

The situation could also have been made more complex by the ever-increasing unpredictability of aid disbursements from Tanzania’s development partners, both bilateral and multilateral.

Combined in an unholy alliance, these factors resulted in a 37 per cent shortfall in the country’s development budget estimates, recent Bank of Tanzania (BoT) figures show.

Only Sh7.39 trillion was actually availed for development expenditure during the 2016/17 financial year, out of the Sh11.8 trillion that was budgeted and duly approved, the central bank notes in its Monthly Economic Review for July 2017.

With disbursements of pledged donor funding being so unpredictable lately, Tanzania this time round received only Sh912 billion out of the Sh1.4 trillion that was earmarked to be sourced in the forms of grants-in-aid and loans on relatively easy terms!

Indeed, the Government-in-Dodoma was able to lay its budgetary hands on only Sh2 trillion out of the Sh3.3 trillion that was planned to be collected as net foreign financing for the government’s revenue and expenditure budget proposals.

Significantly enough, the TRA met its tax revenue collection targets in in terms of value-added tax (VAT) and excise duty on local goods, collecting Sh109.827 billion in total.

However, it underperformed in the import duty and income tax categories by wide margins, BoT figures show.

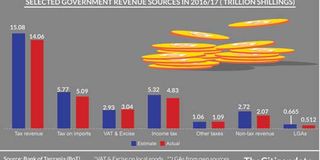

At the end of the day, TRA collected Sh14.055 trillion out of the targeted Sh15.079 trillion for the last financial year.

While the set target for import duty was to collect Sh5.773 trillion, only Sh5.093 trillion was eventually raised. In like manner, only Sh4.83 trillion was collected in income tax out of the original target of Sh5.316 trillion for Government coffers.

The TRA director of tax payer services and education, Mr. Richard Kayombo, attributed the drop in import duty collections to the new ‘Single Customs Territory’ system adopted recently by member countries of the East African Community (EAC).

Under this system, goods from fellow EAC member nations are no longer regarded as ‘foreign imports’ and, “as such, they do not attract import duty.”

Unfortunately, details on the performance of the Income Tax category were not immediately available, and Mr Kayombo promised to provide same to BusinessWeek in due course of time and events.

However, when all is said and done, The Citizen has been made to understand that a number of companies have been laying off workers lately. This is in efforts to realign their operations with the prevailing economic conditions, which are not exactly conducive to increased operational costs.

On the other hand, Acacia Mining PLC announced a few months ago that it would retrench about 100 workers this year, as the company prepares to close down its Buzwagi Gold Mine.

Similarly, Tanzania Distilleries Limited – a subsidiary of the Tanzania Breweries Limited (TBL) Group – laid off 50 workers from its various departments. This was in reaction to the ban on alcoholic beverages packaged in sachets.

With the takeover of TBL’s management from SABMiller by Belgium’s Anheuser-Busch InBev (AB InBev), the biggest brewer in Tanzania is also reported to have laid off more employees in the past few months for assorted reasons.

As if that were not enough of retrogression, some classy hotels have been turned into mere hostels.

The mass media industry has not been spared either – with reports that workers in the industry go for months without pay, while plans for retrenchments remain on the cards.

In January this year, at least three major mobile telephony firms in Tanzania announced that they would retrench their manpower establishments. This was to realign their operations with a government directive requiring the companies to float 25 per cent of their shares on the local bourse, the Dar es Salaam Stock Exchange (DSE).

That came hard on the heels of a government directive to the effect that the companies should separate their telecommunications businesses from their ‘mobile’ financial products and services – such as money transfers, bills payment.

A changing business and economic environment also forced low-cost airline Fastjet to redesign its operations late last year – including retrenching at least 41 of its employees.

Whichever way you look at things, jobs cuts would no doubt have an adverse impact on the pay-as-you-earn (PAYE) system: a withholding tax on the income of salaried employees.

Additional reporting Rosemary Mirondo.

educed imports, falling income taxes and unpredictable donor funding affected the 2016/17 budget execution, data shows.

The Tanzania Revenue Authority (TRA) had to grapple with a decline in goods at the Dar es Salaam Port, latest data show.

That happened at a time when employers were cutting costs – including laying off some of their employees - to align their operations with business and economic conditions.

The situation might have been made complex with the ever-increasing unpredictability of funds from development partners.

The factors resulted in a 37 per cent shortfall in the development budget, latest Bank of Tanzania (BoT) figures show.

Sh7.39 trillion in development expenditure was spent during the financial year 2016/, low than an approved budget of Sh11.8 trillion, BoT noted in its July 2017 economic review, which covered the entire 2016/17 financial year.

With unpredictable donor funding, the country sourced only Sh912 billion out of the Sh1.4 trillion that was earmarked to be sourced in form of grants from aid.

Of Sh3.3 trillion that was planned to be collected as net foreign financing for the revenue and expenditure plan, the government got only Sh2 trillion.

However, TRA met its collection target in the category of sales/VAT and excise duty on local goods by Sh109.827 billion while it underperformed in import and income taxes by wide margins.

As a result, TRA collected Sh14.055 trillion out of a target of collecting Sh15.079 trillion during the entire financial year, BoT figures show.

While the budget was to collect Sh5.773 trillion as import tax, only Sh5.093 trillion was garnered.

Similarly, of the Sh5.316 trillion that was meant to be collected as income tax, only Sh4.83 trillion was obtained.

The TRA director for tax payer services and education, Mr Richard Kayombo, attributed the drop in import duty collection to the fact that under the East African Community (EAC) implementation of a single custom territory, goods from other member states of the bloc are no longer regarded as imports. “As such, they do not attract import duty.”

Mr Kayombo promised to furnish BusinessWeek with details on the performance in the Income tax category after a thorough check.

However, The Citizen understands that during the past months, a number of companies laid off workers to align their operations with the prevailing economic conditions.

A few months ago, Acacia Mining announced it would retrench about 100 people before the end of the year as the company plans to close down its Buzwagi Gold Mine.

Similarly, Tanzania Distilleries Limited – a subsidiary of Tanzania Breweries Limited (TBL) Group – laid off 50 of its staff from across its various departments in reaction to the ban on alcohol sold in sachets.

With the takeover of TBL’s management from SABMiller to Belgium’s Anheuser-Busch InBev (AB InBev), the company is also reported to have laid off more employees during the past few months.

Some hotels have been turned into hostels. The media industry has not been spared either with reports that workers in the industry go for months without pay while plans for retrenchments remain on their cards.

In January this year, at least three major mobile phone firms announced that they would retrench shed their manpower to align their operations with a directive to float 25 per cent of their shares to the public.

That came hard on the heels a government directive to the effect that they should separate their telecommunications businesses from their financial services (money transfer and bill payment) products.

Late last year, a changing business and economic environment also forced low-cost airline Fastjet to redesign its operations, including retrenching at its least 41employees.

The job cuts could have an impact on the Pay As You Earn – a withholding tax on taxable incomes of employees.