Soft drink producers retrench 720 workers

What you need to know:

- Bakhresa Group attributes factors such as delayed refunding in additional import duty and tough operational conditions

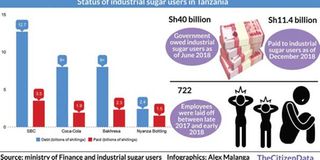

Dar es Salaam. Soft drink producers laid off 722 employees between late 2017 and early last year due to cash-flow constraints, The Citizen has learnt.

They attribute the shrinkage in cash flow to, among others, delayed payments of 15 per cent refundable import duty on industrial sugar, tough operational conditions and increased competition.

As of June, 2018, according to the Confederation of Tanzania Industries (CTI), the government was withholding more than Sh40 billion it owes food, beverage and pharmaceutical industries.

But early February, Finance and Planning minister Philip Mpango told Parliament that the government had until December 2018 paid Sh11.4 billion to six companies.

They included, with the amounts in brackets, SBC Tanzania Ltd (Sh3.5 billion), Bonite Bottlers Ltd (Sh1.7 billion), Nyanza Bottling Company (Sh1.5 billion), Coca-Cola Kwanza Ltd (Sh1.9 billion), Bakhresa Company Ltd (Sh2.3 billion) and Jambo Food Products Ltd (Sh500 million).

“It is encouraging, but more should be done,” Coca-Cola Kwanza Public Affairs and Communications director Haji Mzee told The Citizen.

He said it was in October or early November since last payments were made, stressing that if there was a good will of follow-up, Coca-Cola would have been already paid another installment.

He said delayed refund increased production costs.

The government has paid some Sh1.9 billion out of over Sh8 billion to Coca-Cola Kwanza, according to Mr Mzee.

“Delay in refunding is eating into our operating capital. As a result we had to lay off about 100 people. At the industry level almost 722 people were laid off,”he lamented.

Nyanza Bottling human resource official Harish Nair said the government had paid some Sh1.5 billion out of Sh2.4 billion to the company.

According to stakeholders, some manufacturers were forced to resort in taking bank overdrafts to cater for their operational expenses, increasing costs.

CTI policy and advocacy acting director Akida Mnyenyelwa noted: “The government ought to speed up repaying the refunding, or else, costs of production would escalate and make locally produced products uncompetitive.” Dr Mpango allays fears over delays in repayment, saying the government would ensure they are paid.

Bakhresa Group has been paid Sh2.3 billion out of over Sh8 billion.

Without quantifying, the group’s corporate Affairs director, Mr Hussein Sufian, said since 2017 a significant number of employees had been retrenched due to multiple factors such as delayed refunding in additional import duty, tough operational conditions and tough competition.

Debating a report of the Parliamentary Committee on Industry, Trade and Environment in the House early this month, a section of lawmakers criticised the government for treating industrial users badly. The committee’s chairman, Mr Suleiman Saddiq, warned that delayed refunding would seriously affects the companies.

Ms Zainabu Mndolwa (Special Seats -- CUF) opined: “The government should take this matter seriously by instituting measures that will expedite the refund process.”

Vunjo MP James Mbatia (NCCR-Mageuzi) called for the removal of additional 15 per cent on import duty to reduce inconveniences.

“The imposition of 15 per cent additional import duty is more likely to impede innovation and eventually cause job losses.”

Initially importers of industrial sugar were being charged 10 per cent.

However, the government in 2015/16 raised it to 25 per cent, pledging to return the additional 15 per cent if the government satisfied that the consignment was really imported for industrial purposes.

SBC Tanzania corporate affairs head Alexander Nyirenda said the speed of refund is not fast enough, explaining that Sh3.5 billion out of Sh12.7 billion paid to the firm.

That was for the deposits paid up to December 2016.

“TRA [Tanzania Revenue Authority] promised that to do verifications monthly and that we would get our refunds the same way but this has not been the case. We are not able to pay our suppliers on time. We have reached a stage where we are pushed to relook and start retrenching employees.”

SBC had to borrow money to keep its operations going.

The interest that the company pays to the lender is about Sh1.5 billion a year, according to him.

Efforts to reach Bonnite and Jambo Food Products Ltd for comment proved futile.