Investors in only two local firms profit at Dar bourse

What you need to know:

TBL Group (TBL) and the self-listed DSE Plc are the only counters which gained during the period if their prices while majority of the listed firms either decreased or remained unchanged, data show.

Dar es Salaam. Only two out of the 18 local companies trading on the Dar es Salaam Stock Exchange (DSE) have gained in their share prices since the beginning of the year, indicating a tough experience for investors to increase wealth through the bourse.

TBL Group (TBL) and the self-listed DSE Plc are the only counters which gained during the period if their prices while majority of the listed firms either decreased or remained unchanged, data show.

TBL gained by 12.6 per cent from Sh11,100 per share on January 2 – the first trading day of 2017 - to Sh12,500 on June 30 meaning that the wealth of an investor improved by that rate during the six months.

In simple language, if one bought TBL shares worth Sh10 million on January 2, 2017, their wealth could have increased to Sh12.6 million on June 30.

The brewer’s market capitalisation improved from Sh3.54 trillion to Sh3.95 trillion at the end of the first half of the year.

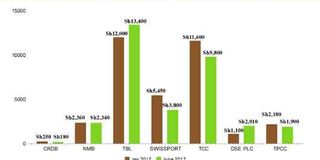

TBL gained by 11.7 per cent from Sh12,000 per share on January 2 – the first trading day of 2017 - to Sh13,400 on June 30 meaning that the wealth of an investor improved by that rate during the six months.

In simple language, if one bought TBL shares worth Sh10 million on January 2, 2017, their wealth could have increased to Sh11.17 million on June 30.

The brewer’s market capitalisation improved from Sh3.54 trillion to Sh3.95 trillion at the end of the first half of the year.

DSE Plc also gained by 11.6 per cent from Sh1,000 per share to Sh1,160 while the company’s market capitalisation jumped from Sh20.25 billion to Sh27.64 billion.

On the other hand, five counters depreciated with others dipping as much as 30 per cent while the remaining 11 of the local listed firms remained unchanged.

CRDB Bank (CRDB) depreciated by about 30 per cent. The bank’s share started the year at a price of Sh250 but it dropped to Sh180 on June 30. However, the counter has improved significantly and has been attracting buyers for a good part of July due to what analysts called price convenience. As of Friday last week, a CRDB share was trading at Sh210.

Ground and air cargo service provider Swissport also lost value by 30.3 per cent while Tanzania Portland Cement Company Ltd depreciated by 21.4 per cent during the period.

Mkombozi Commercial Bank (MKCB) and Tanzania Cigarette Company (TCC) dropped by 10 per cent and 3.9 per cent respectively in the trading which experts say was mainly overshadowed by the anticipated telecoms listing.

Optimism ahead

“December and January are normally low in trading of the stock markets but this was maintained by the shift of investor focus to telecoms’ initial public offerings especially that of Vodacom which has not completed,” says Zan Securities chief executive officer Mr Raphael Masumbuko.

The Vodacom IPO which seeks to raise Sh476 billion through the sale of 560 million shares was recently extended to July 28 to accommodate foreign investors following the amendment of the law which allowed them to participate in the local IPOs. The Electronic and Postal Communications Act (Epoca) 2010 requires telecommunications firms to offload 25 per cent of their stake through the IPOs but the foreign investors were not allowed in order to enhance local participation in the telecommunication industry.

However, amendment made through the Finance Act 2017 - after the Vodacom IPO reportedly flopped - allows foreign investors to take part in the local IPOs.

“I hope the market will return into normal trading once Vodacom shares are listed. Investors are now delaying to see what will happen in this biggest-ever IPO. I also believe that listing of mobile phone operators will bring in more foreign investors as well as increase public awareness on capital markets in the country,” says Mr Masumbuko.

Despite the depreciation of many counters, the domestic market capitalisation increased from Sh7.73 trillion to Sh7.76 trillion.

The domestic market capitalisation is so heavily exposed to TBL which accounts for about a half of it that any significant price change results into the change of market cap or indices.

Globally, the increasing nationalistic trend especially in the US and an economic slowdown experienced by China – the second largest economy – are reducing demand as well as appetite for investment hence affecting African capital markets.

Tanzania’s change of rules for foreign participation in the local IPOs was also another factor that shaped the DSE performance.

“All these factors are leading to a wait-and-see among investors especially on the secondary market,” says DSE chief executive officer Mr Moremi Marwa. The volatility in the counters is seen by other experts as an opportunity for investment.

“Up and down in share trading is actually good for a dynamic market. All this is influenced by market forces and I see a better future considering that there was no any company dropped due to a horrible financial performance or any other poor prospects,” says Mr Juventus Simon, general manager at Orbit Securities Ltd.

The DSE also trades government and corporate bonds. Efforts are underway to start trading government retail bonds after successfully starting corporate retail bonds done by Exim Bank and NMB bank.

“A consultant has already submitted the report on the government retail bond for comment and before the end of August this year, there will be stakeholders workshop for comments and later come up with the final report,” says spokesperson of the Capital Markets and Securities Authority (CMSA) Mr Charles Shirima.

“The start of government retail bond will pave the way for infrastructure bond and M-Akiba,” he adds.

Kenya has a similar product which started recently but Mr Shirima says it was originally developed in Tanzania and Kenya was fast to implement the idea.