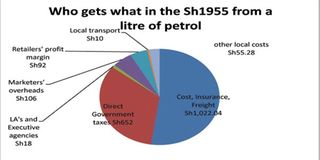

How taxes, fees eat into decreases in oil prices

However, petroleum experts say the low-sulphur fuel is expensive and probably will neutralize the fall of prices.

What you need to know:

This comes at a time when debate is still hot regarding reasons why petroleum products in the local market have not gone down to reflect declining global prices.

Dar es Salaam. Government taxes and its various agencies account for close to half of the amount that Tanzanians pay on every litre of petroleum products, a development that denies the country a chance to reap massive benefits from declining global fuel prices, data shows.

This comes at a time when debate is still hot regarding reasons why petroleum products in the local market have not gone down to reflect declining global prices.

At global level, price of crude oil has decreased by about 40 per cent from an average of $100 to $60 per barrel between last September and January this year but in Tanzania, it has not gone down at the same magnitude as affected by different factors.

An analysis of data used in calculating cap prices reveal that of the Sh1,955 that a Dar es Salaam resident pays to buy a litre of petrol this month, almost 40 per cent of it goes to the government and some of its agencies in the form of fixed taxes and other regulatory charges.

The remaining part is influenced by trends in the world market and transportation cost.

This leaves the investor with Sh92 as profit margin on every litre sold after deducting the local transport charges.

As the crude oil reduces by 40 per cent in the global market, petrol, diesel and kerosene in the local market dropped at a rate of 16 per cent, 13 per cent and 11 per cent respectively, a situation that raises concerns from a cross section of stakeholders including the chairman of Parliamentary Public Accounts Committee (PAC), Mr Zitto Kabwe.

But the government maintains that existing taxes are reached at after a thorough review and after putting into consideration the country’s needs.

“The government does review taxes from time to time…we do not review taxes only when prices go down. What if the prices go up, would you want the government to increase taxes as well,” argues Mwigulu Nchemba, deputy Finance minister.

“Every year we do review and we look at various economic factors including final prices to consumers and inflationary factors,” he says.

Energy and Water Utilities Regulatory Authority says the prices have fallen reasonably during the time.

For instance, a litre of petrol which was sold at Sh2,267 in September is now trading at Sh1,955 in Dar es Salaam, being a reduction of Sh312. Diesel has also reduced from Sh2,091 to Sh1,846 in the same period while kerosene dropped from Sh2,040 to Sh1,833.

Ewura says it is unfair to make comparison of price decreasing rates using the price of crude oil while the country imports refined products.

Apart from the refinery cost, Ewura director general Felix Ngamlagosi says factors like government taxes, transport cost and the weakening local currency against the US dollar must be considered in the price calculation. He says it takes up to three months for the fuel procured in the particular period to be in the market and therefore impact is delayed to be felt.

The Tanzanian shilling has weakened from Sh1,668 in September 2014 to Sh1,729 in January 2015, about four per cent fall.

Ewura Consumer Consultative Council chairman Prof Jamidu Katima said the issue of taxes is known, noting however, that they do not think the government may be willing to reduce further.

“We had discussions with the government and other stakeholders on this problem when there was a fuel crisis in recent years and it was actually reduced to that level. For now, we do not see any possibility of having the taxes cut down further, for doing so would affect government revenue to finance the Budget,” he says.

“Fuel levies make a large component of the government revenue and therefore reducing it abruptly may shake the Budget,” he says.

Prof Katima explains that the current low drops in local pump price is a result of complications in the way fuel is imported under the Bulk Procurement System where a firm bids to import oil after two or three months using current prices in the world market.

“When the importer quotes today, anything can happen in the future. Prices may either increase or fall in the world market. We normally complain and demand price cuts when global prices fall but what if they go up? It’s really tricky and complicated,” he comments.

Tanzania is a net importer of refined petroleum products for consumption since 2000 when its refinery was closed at Kigamboni.

In 2005, the country phased out leaded petrol, under the Tanzania Bureau of Standards (TBS) specifications, and since then it has been importing and selling unleaded petrol.

The country is planning to reduce content of sulphur in both petrol and diesel from the current levels of 500 parts per million (ppm) to 50 ppm starting this year.

Mr Ngamlagosi says the new specifications are now being implemented and soon the country will start using the low-sulphur fuel.

However, petroleum experts say the low-sulphur fuel is expensive and probably will neutralize the fall of prices.

World Bank says in its analysis that soft oil prices are expected to persist in 2015 and for many oil-importing countries; lower prices contribute to growth and reduce inflationary, external, and fiscal pressures.

The analysis argues that if lower oil prices persist, they could also undermine investment in new exploration or development. This would especially put at risk investment in some low-income countries, or in unconventional sources such as shale oil, tar sands, and deep sea oil fields.