Analysts see oil prices staying in the $30s for several months

Riyadh. Oil prices will likely remain at current depressed levels for months amid a price war and the fight for market share while the coronavirus outbreak batters oil demand, a Reuters poll of analysts has shown.

According to the 21 experts surveyed by Reuters, WTI Crude prices are set to average $30.37 a barrel in the second quarter this year and $37 for the full year.

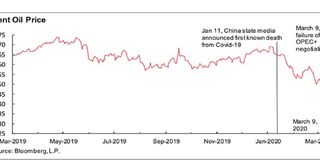

Early on Friday, WTI Crude was trading at $33 a barrel, up on the day but down by a massive 25 percent on the week for what is shaping up to be the worst week for oil prices since the financial crisis in 2008.

Brent Crude prices are seen averaging $34.87 per barrel in Q2 and $39.05 in Q3, according to the Reuters poll. In Q4, Brent Crude is expected to climb to $44.08.

The average Brent Crude price forecast in the latest poll for full-year 2020 is $42 a barrel, down from $60.63 expected in a poll in February.

Early on Friday, Brent Crude was up 5 percent at $36.92.

After the collapse of the OPEC+ production cut deal, major banks slashed their oil price forecasts, expecting an enormous oversupply in the market now that Saudi Arabia, the United Arab Emirates (UAE), and Russia are turning on the taps and looking out for their own interests instead of trying to fix the prices and the market as a grand coalition of producers.

Goldman Sachs is warning that the market may see $20 oil in Q2, Standard Chartered says WTI Crude will average just $32 a barrel in 2020, and ING slashed its Q2 Brent Crude forecast to $33 a barrel from $56, to name a few.

Saudi Arabia has promised to flood the oil market with an extra 2.6 million bpd of oil from April, while its fellow OPEC producer and ally, the United Arab Emirates (UAE), pledged an additional 1 million bpd in supply.

This will result in a total increase of 3.6 million bpd in global oil supply from OPEC’s heavyweights at a time of depressed oil demand due to the coronavirus outbreak and at a time of crashing oil prices, following the abrupt end to the OPEC+ deal last week.

Former ally Russia, for its part, says it can raise its oil production by 200,000 bpd to 300,000 bpd in the short term. (Oilprice)