Tanzania’s banking industry: History, evolution and inclusiveness

The current view of the Bank of Tanzania’s Twin Towers and the old structure in-between the two towers. The central bank is the statutory financial regulator of the country. Monetary issues fall within Union Matters. PHOTO | FILE

What you need to know:

- Tanzania’s financial sector has passed through many phases in the last six decades, all of these have had their bearing on banking - which, however, has been growing from strength to strength

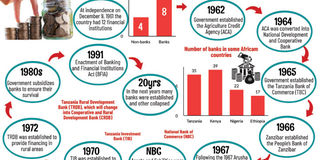

Dar es Salaam. Tanzania’s banking sector is one of the most vibrant in the region, with its number of commercial banks higher than that of bigger economies in the continent.

Data from the central Bank of Tanzania (BoT) show that Tanzania has 35 commercial banks. This is more than the number of banks in larger economies like Nigeria (22) - but is only slightly lower than that of the larger economies of Kenya (39) and Egypt (40).

The latest BoT banking supervision report shows that the industry had mobilized deposits to the tune of Sh24.76 trillion in 2020, with total assets being Sh34.69 trillion.

Moreover loans, advances and overdrafts stood at Sh18.78 trillion.

The vibrancy of the industry is a clear example of key strengths that the Tanzanian economy possesses: resilience and high capacity for adjusting to change.

In fact, the evolution of the banking industry in the last 60 years gives a more visible picture of how the Tanzanian economy has performed and the mileage ahead the country still has to cover to attain its sustainable economic targets.

As the case has been historically in Africa, Tanzania started out with the majority of the population alienated from the formal economy. The informal economy is traditionally out of the reach of the banking industry, which means that despite the fact that Tanzania had a number of private banks at independence the millions of Tanzanians could not access services in these banks.

They were there to serve mostly officials in the colonial system and the foreign traders, merchants and small but burgeoning middle class that existed then. At independence all of the banks were foreign owned. To date Tanzania is still struggling with this alienation, which is a negative aspect that highlights the imbalances of the global economic forces.

The nationalization of banks and financial institutions following the Arusha Declaration of February 5, 1967 did not result in improved financial inclusiveness due to various factors, despite government efforts to establish non-financial institutions to serve the rural and periphery areas, such as Tanzania Rural Development Bank (TRDB), the large population remained outside the banking industry after its liberalisations of the early 1990s.

The entry of the private banks, many of them foreign-owned, did little to bridge the gap in access to banking services in the country. This was not until mobile banking arrived, thanks to the digital technology revolution that is the hallmark of the 21st century.

Digital technologies are now driving the banking industry for better or worse, while increasing access to the services to Tanzanians at unprecedented levels.

About 60 years after political independence from Britain on December 9, 1961, millions of Tanzanians can now access banking products and services in the comfort of their homes through their mobile phones.

Digital technologies have also facilitated agent banking, which was not possible in the past. Agent banking enables banks to delegate key services such as opening of accounts, deposits and withdraws to registered agents scattered throughout the country. This has not only reduced the burden of banks to open more branches, it has also taken banking services closer to people and increased hours of access to services. BoT data indicated that 93 per cent of all deposits in the banking industry were done through agents in 2020. While total deposits in the industry stood at Sh24.77 trillion, deposits through agents stood at Sh23.17 trillion. The total number of agents nationwide was 40,410. BoT introduced comprehensive agent banking guidelines that permit licensed banks and financial institutions to appoint retail agents for their banking services in 2013.

“The growth in agent banking implied that this service delivery channel has become a more effective means of mobilizing savings and increasing access to and usage of banking services,” the BoT says.

History of banking

At independence on December 9, 1961, the country had only eight banks and four non-banking financial institutions. The commercial banks, all of which were foreign owned included the Standard Bank of South Africa, National and Grindlays Bank, Barclays Bank-DCO and Ottoman Bank. Others were the Bank of India, Bank of Baroda, Commercial Bank of Africa, and the National Bank of Pakistan.

The non-banking financial institutions (NBFIs) included the Post Office Savings Bank, Land Bank, Local Development Loan Fund and African Productivity Loan Fund.

“The colonial banking system was characterized by dominance of foreign owned commercial banks, inability to sufficiently mobilize savings and deploying funds to productive sectors of the economy, and concentration in urban areas,” says the BoT.

In 1965 the government established the Tanzania Bank of Commerce (TBC). The following year, in 1966 the government of Zanzibar established the People’s Bank of Zanzibar in 1966, according to historical accounts from the BoT. Soon after independence, in 1962, the government established the Agriculture Credit Agency, to foster loans to farmers. ACA was converted to National Development and Cooperative Bank in 1964.

Following the Arusha Declaration in 1967, all private commercial banks were nationalized and their assets and liabilities were merged to form one big commercial bank, namely the National Bank of Commerce (NBC). This bank became wholly owned by the government.

Mr I G Konradsen, a Danish citizen, who was by then the deputy banking manager of the Central Bank of Tanzania, was appointed acting general manager of the new bank, pending the recruitment of a local, according to historical accounts.

Having established one big commercial bank, the government focused on establishing financial institutions to cater for various needs in other sectors such as agriculture, industrialization and housing.

In 1970 the Tanzania Investment Bank (TIB) was established to provide development finance to the country’s productive sectors, especially large-scale industry. In 1972 Tanzania Rural Development Bank (TRDB) was established to provide financing to the rural sector. The bank was later restructured and changed its name to Cooperative and Rural Development Bank (CRDB). In the same year, Tanzania Housing Bank (THB) was established to specialize in the financing of rural and urban residential, office and commercial buildings.

During this period the only financial institutions that were not owned by the government were the Tanzania Development Finance Limited (TDFL) and Diamond Jubilee Trust Fund.

Liberalisation of banking

The lack of competition, little integration with the global banking system and the economic crisis of the 1980s led to disastrous performance of the banking sector to the extent that the government had to subsidize banks for them to survive. Which means the government giving banks money to enable them stay afloat, instead of the banks giving dividends to the government as it is now the case.

Because of that losses and non-performing assets (NPAs) were the order of the day. Woes of the banking sector were also because of the fact that there was no regulation.

The government, then, moved to allow private and foreign-owned banks to operate to boost the banking and financial sector.

The first thing that the government did was to enact the Banking and Financial Institutions Act (BFIA) in 1991. The Act gave the BoT powers to license, regulate and supervise banks and financial institutions.

The Act also allowed entry of foreign and domestic private banks in the market. Before 1991 the Bank of Tanzania did not have legal powers to regulate and supervise banks and other deposit taking institutions, according to a historical analysis of banking in Tanzania from the BoT. “All banks and financial institutions that existed before 1991 were established by independent acts of parliament and they were all government owned,” the BoT said.

A year after opening up the banking industry, the first bank was registered. This was the Meridian Biao Bank Tanzania Ltd. A year later, in 1993, Standard Chartered Bank Tanzania Ltd opened doors. Other banks then followed; Eurafrican Bank Tanzania Ltd (1994), Citibank Tanzania Ltd and the Stanbic Bank Tanzania Ltd (1995). Stanbic Bank took over assets of Meridian Biao Bank Tanzania Ltd after it collapsed that year.

The Cooperative and Rural Development Bank was also restructured into a private bank in 1996 and renamed CRDB (1996) Bank Ltd. This bank later changed its name to CRDB Bank PLC. The NBC was restructured in 1997 and three separate entities were formed, namely NBC (1997) Ltd, the National Microfinance Bank Ltd and Consolidated Holdings Corporation.

In the 20 years after opening up the banking sector Tanzania experienced failures of six banks and financial institutions. These were Tanzania Housing Bank (THB) Meridian Biao Bank that failed in 1995, the Trust Bank Tanzania Ltd, which collapsed in 1998, Greenland Bank Tanzania Ltd that collapsed in 1999. Other banks included Delphis Bank Tanzania Ltd that failed in 2003 and First Adili Bancorp, which collapsed in 2000.

“Most of these failures were triggered by failures of their parent banks. In all these cases, no depositor lost a cent. Only two banks (Greenland and THB) were liquidated while others were taken over by other banks,” the BoT says in its report.

The government also encouraged formation of regional and community banks and financial institutions in various parts of the country, in order to assist Tanzanians to have access to banking services in their localities. As of December 2010, there were eight regional/community banks operating in Tanzania, namely Mbinga Community Bank, Dar es Salaam Community Bank, Mwanga Community Bank, and Mufindi Community Bank. Others were Kagera Farmers Co-operative Bank, Kilimanjaro Cooperative Bank Ltd, Njombe Community Bank, and Tandahimba Community Bank.

The banking industry reached a peak of 59 licensed banking institutions in 2017, according to the banking sector analysis by tanzaniainvest.com. The number started to decrease to 53 in 2018, 51 in 2019, 49 in 2020, and 47 in 2021.

In 2018, BoT revoked the banking licences of five banks on the basis of their undercapitalization, according to tanzaniainvest.com. The banks included Covenant Bank, Efatha Bank, Njombe Community Bank, Kagera Farmers’ Cooperative Bank, and Meru Community Bank. BoT also took over the administration of Bank M Tanzania due to the bank’s critical liquidity problems and its inability to meet its maturing obligations. During the same year, Twiga Bancorp merged with TPB Bank retaining the name TPB Bank.

A new bank, the China Dasheng Bank (CDBL) entered the Tanzanian market and was issued a banking business licence in November 2018. In 2019, the number of banks further decreased with the acquisition of UBL Bank Tanzania by Exim Bank Tanzania, BoT’s transfer of assets and liabilities of Bank M Tanzania to Azania Bank.

In 2020 the BoT approved a number of mergers and acquisitions and took over administration of one bank.

“The mergers and acquisition were aimed at enhancing the respective banks’ market share, improving efficiency and performance as well as ensuring compliance with regulatory requirements,” the BoT says.

TPB Bank Plc merged with TIB Corporate Bank Ltd to form a new bank, namely, Tanzania Commercial Bank Ltd.

In addition, NIC Bank (T) Ltd and Commercial Bank of Africa (T) Ltd merged to form NCBA Bank (T) Ltd while National Bank of Malawi acquired 75 percent ownership of Akiba Commercial Bank Plc.

Further, Mwanga Rural Community Bank Ltd acquired EFC Microfinance Bank (T) Ltd and subsequently merged with Hakika Microfinance Bank Ltd to form Mwanga Hakika Microfinance Bank Ltd.

The Bank of Tanzania placed China Commercial Bank (T) Ltd under administration due to failure to comply with regulatory capital requirements.

Subsequently, the Bank transferred assets and liabilities of China Commercial Bank (T) Limited to NMB Bank Plc as a resolution option to protect the interest of depositors and other creditors as well as maintain stability of the banking sector.

Despite the vibrancy of the industry most of the banking assets and liabilities are still concentrated in the few big banks.

Analysis of banks’ market share indicates that ten largest banks dominated the market in 2020 and accounted for 72.94 percent of total assets, 73.68 percent of total loans and 75.43 percent of total deposits.